Shoppers purchased more items from Amazon this holiday season than any previous holiday period. The e-commerce giant reported better-than-expected revenue and profits for the fourth quarter, jumping to $170 billion driven by strong consumer spending during the holiday shopping season. More than one billion items were purchased worldwide during the company's Black Friday and Cyber Monday holiday shopping events.

Like other retailers, Amazon's marketing tried to convert holiday shoppers with fast-shipping and discount events, including an October Prime Day event. In a statement, Amazon CEO Andy Jassy called it a “record-breaking” holiday shopping season for the company, which saw a 14% growth in revenue compared to the same period in 2022.

The Market Defense Top 25 Beauty & Personal Care Products in Q4 2023 included a mix of 2023 TikTok viral hits and beauty pantry staples. The holiday season at Amazon saw solid consumer spending and good momentum in its ad business.

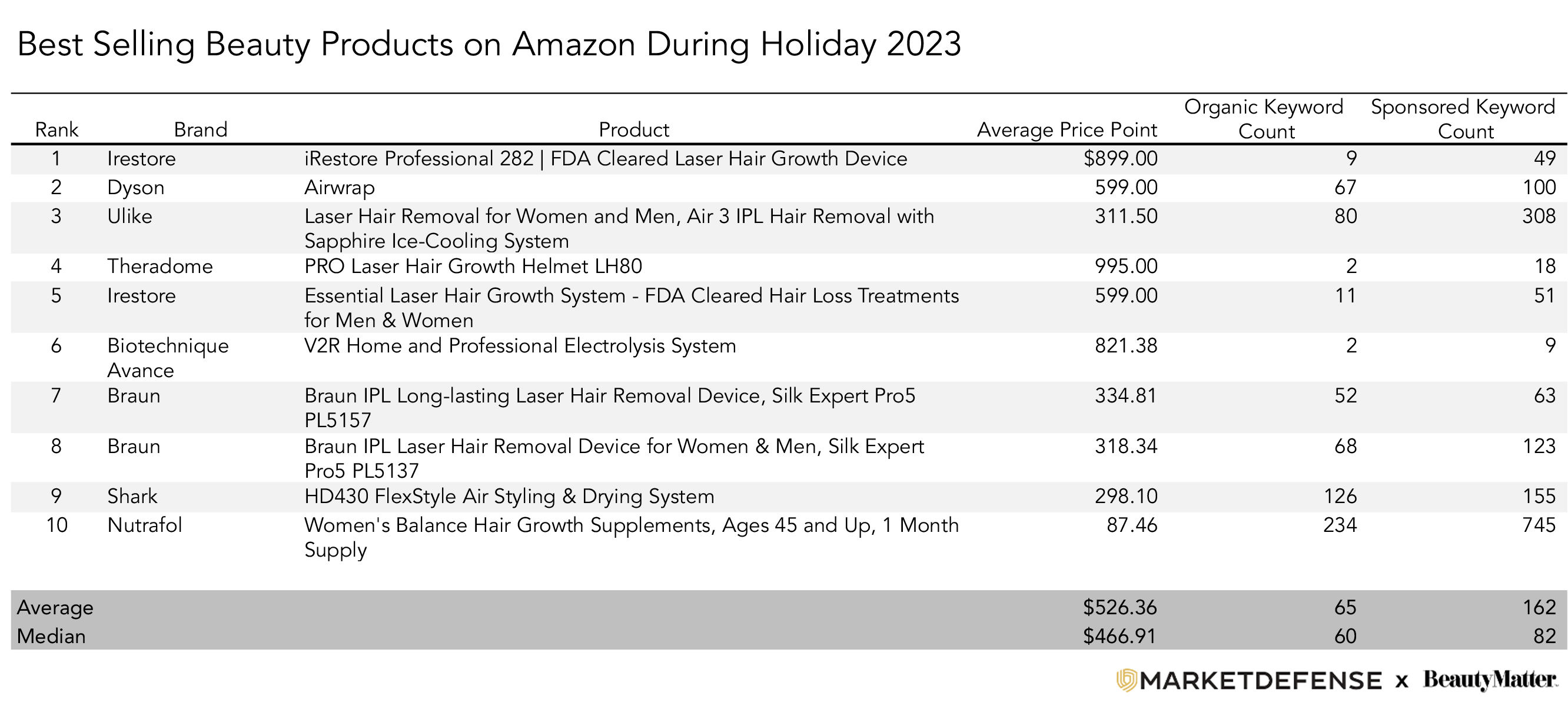

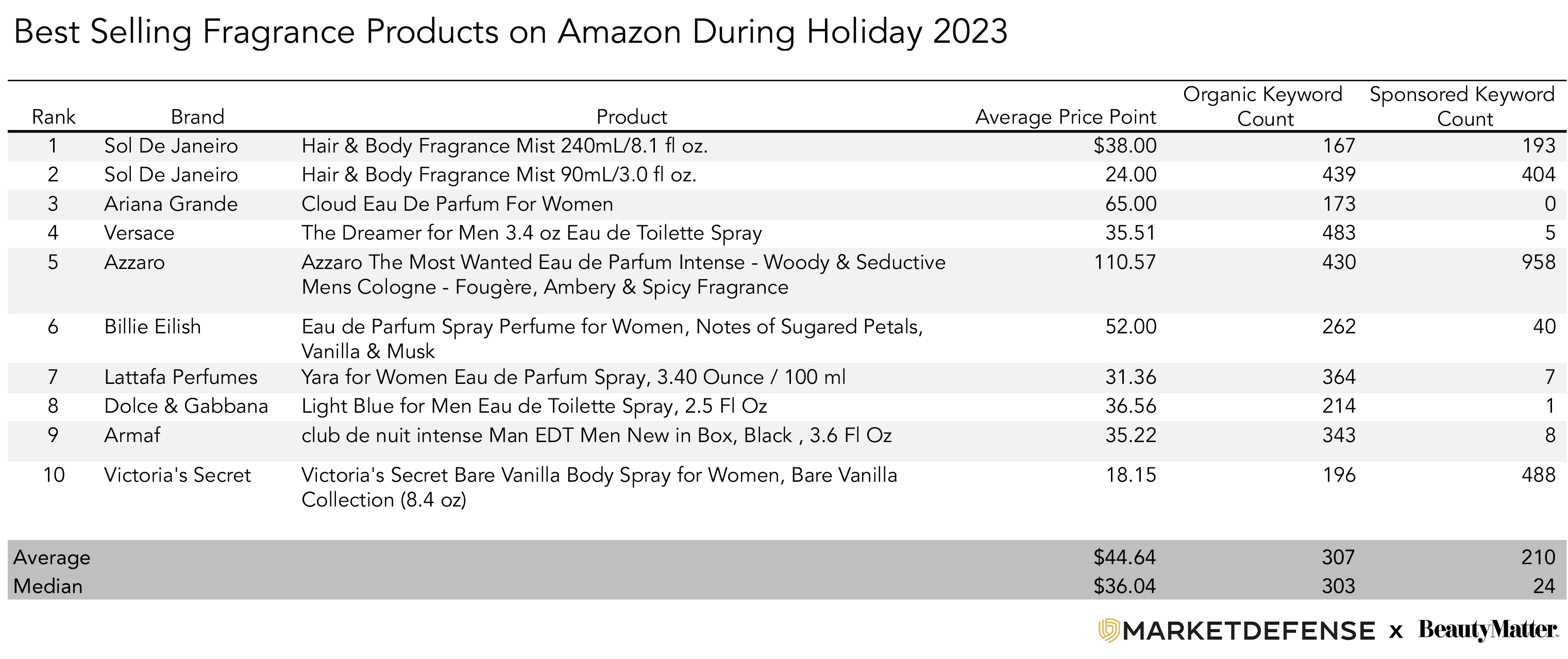

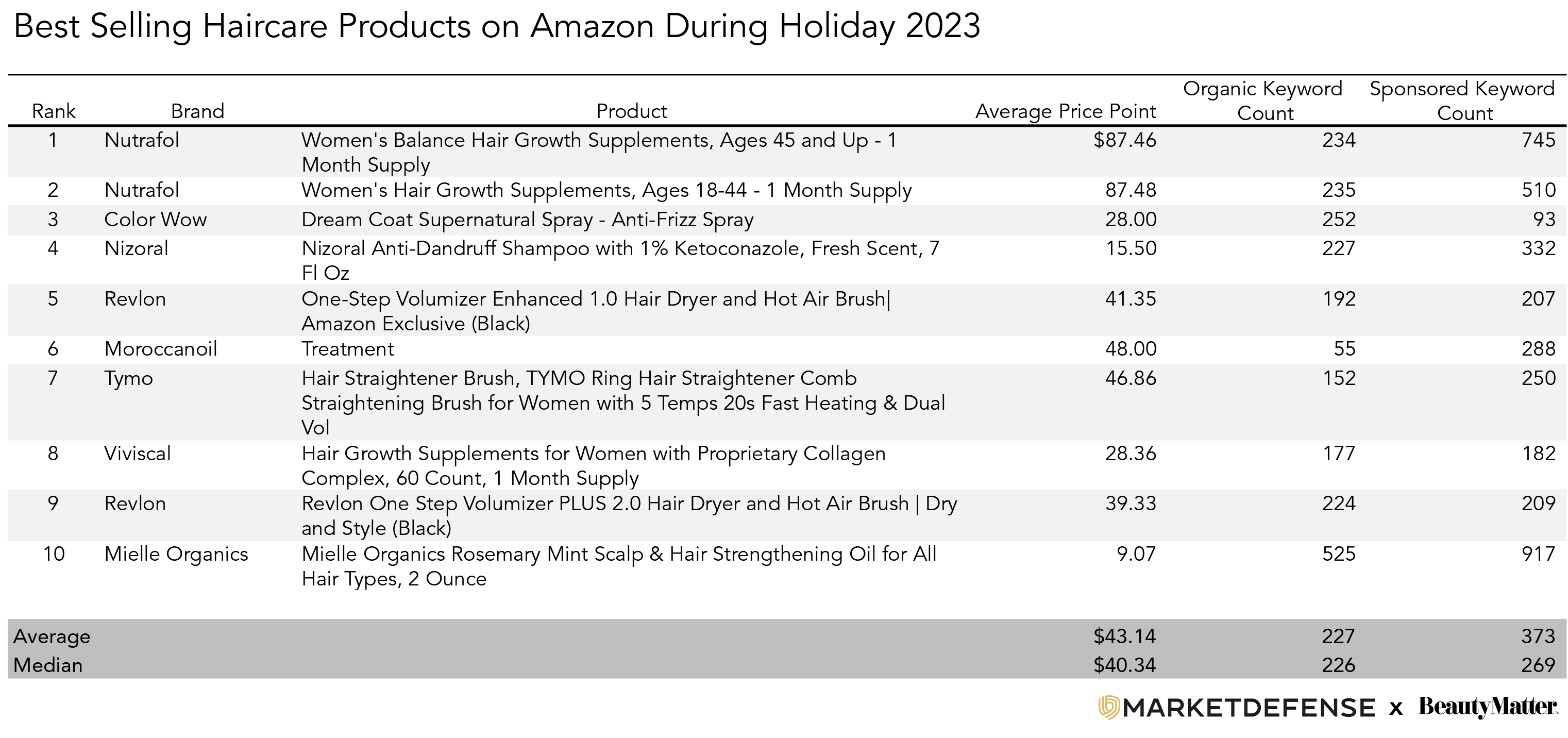

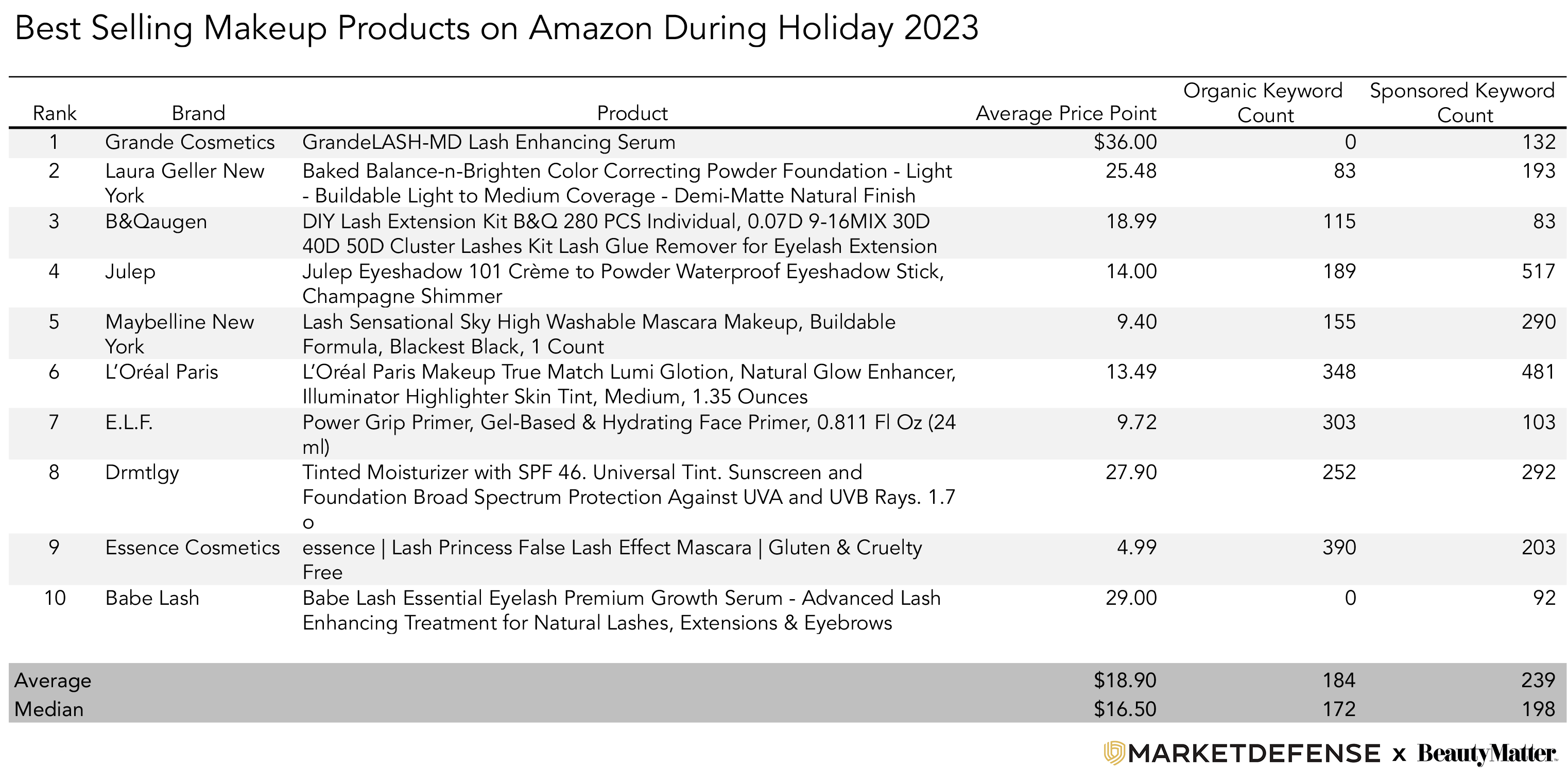

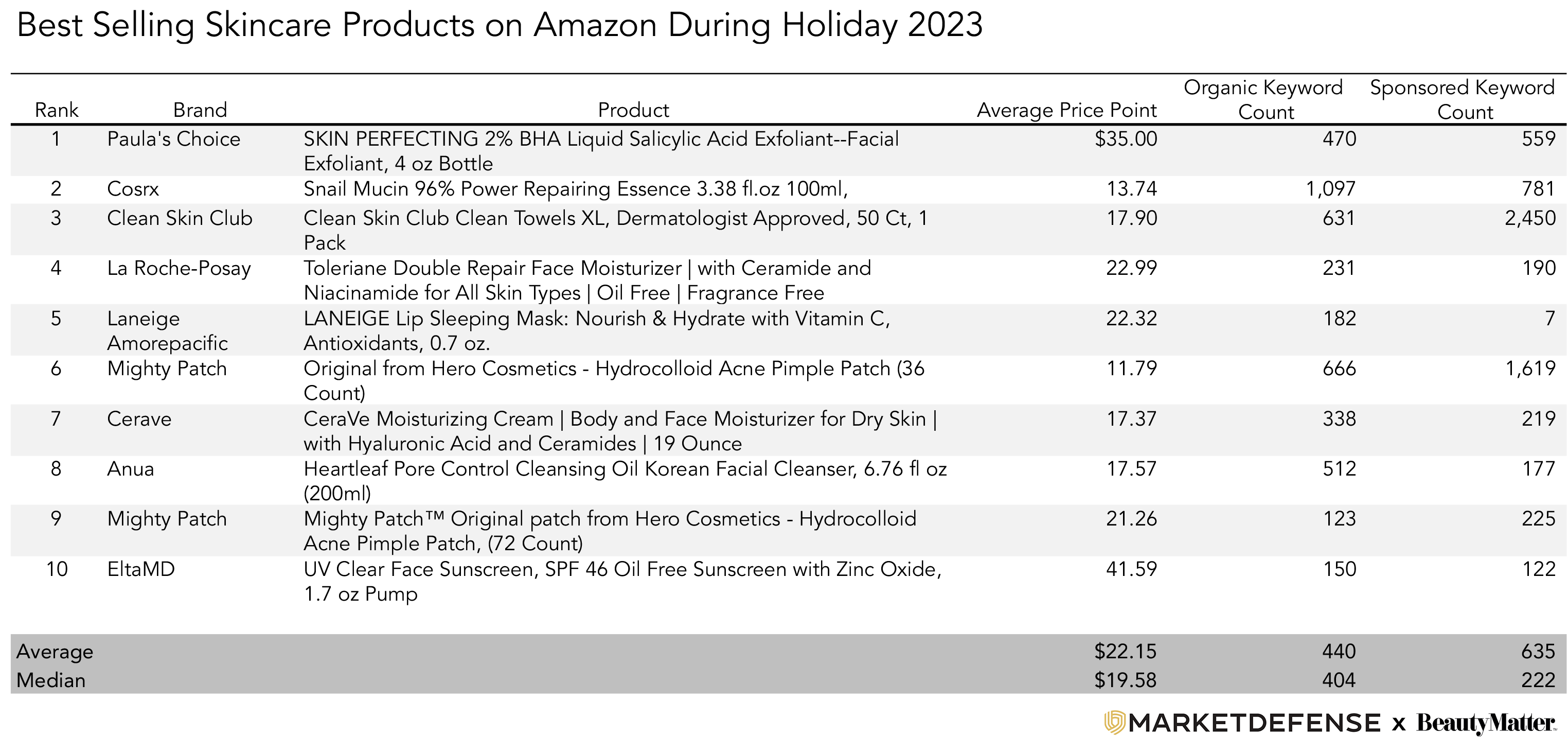

Amazon Beauty Holiday Bestsellers

Amazon usually favors lower-priced products in the organic rankings because it helps the conversion rates and sales velocity. Lower price points combined with aggressive advertising to drive more sales velocity across a wide variety of products help brands like Conair rank organically across many top-searched keywords on Amazon. For holidays, we increased the scope of categories tracked, and results showed a significant increase in the average and median price points across categories.

Dave Karlsven, SVP of Client Marketing and Data Science at Market Defense, shared, “Because we have a portfolio of many of the top-selling Beauty brands on Amazon, it has allowed us to gather large amounts of advertising and sales data across all the beauty categories on Amazon."

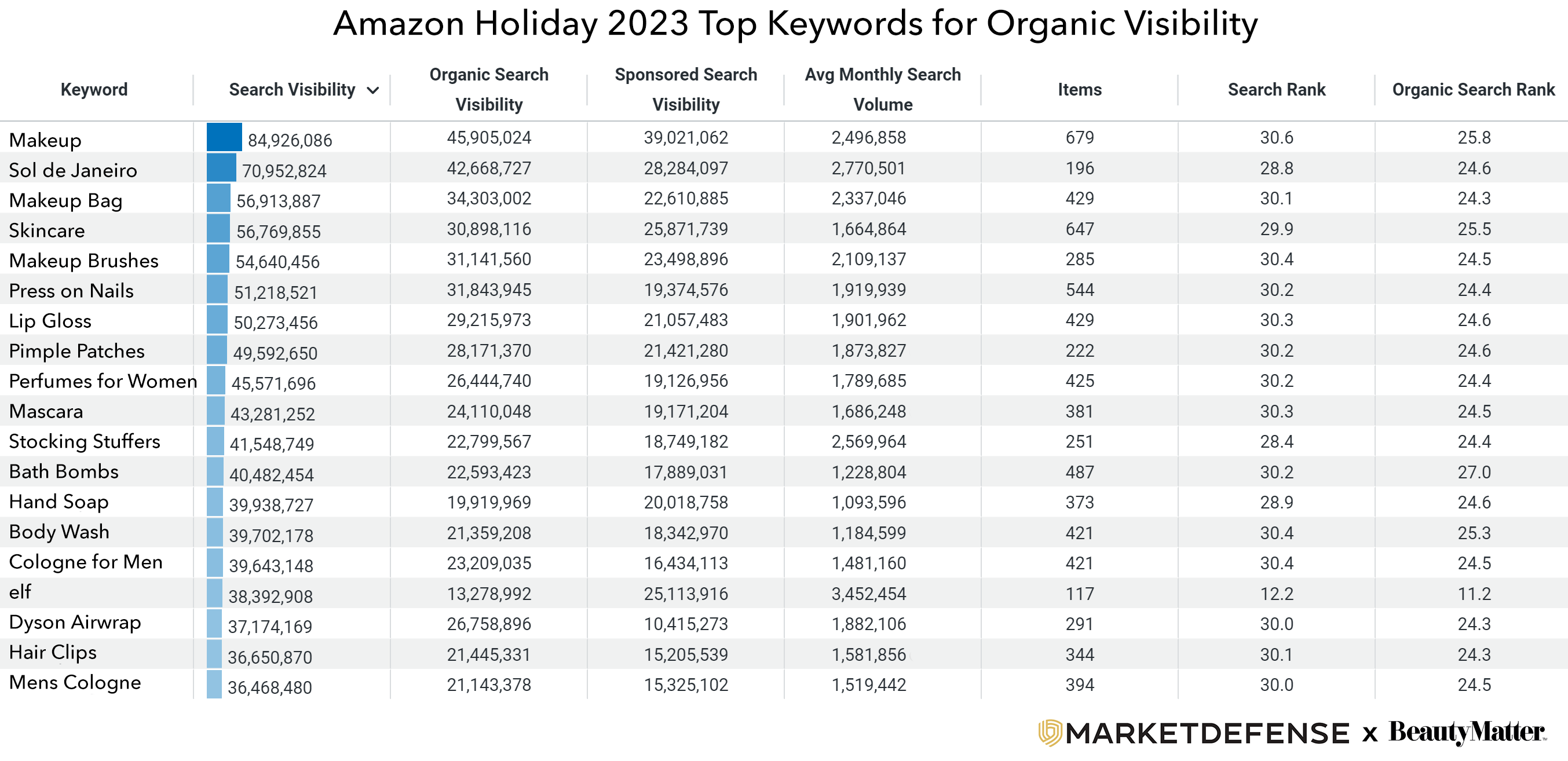

Top Keywords for Organic Visibility:

Variations of different "Makeup" keywords drive the most organic search visibility for brands selling products in the Beauty department. However, niche, nonbrand keywords like "Press on Nails" and "Lip Gloss" can also have a lot of search volume. "Sol de Janeiro" is consistently the top searched brand on Amazon in the Beauty department.

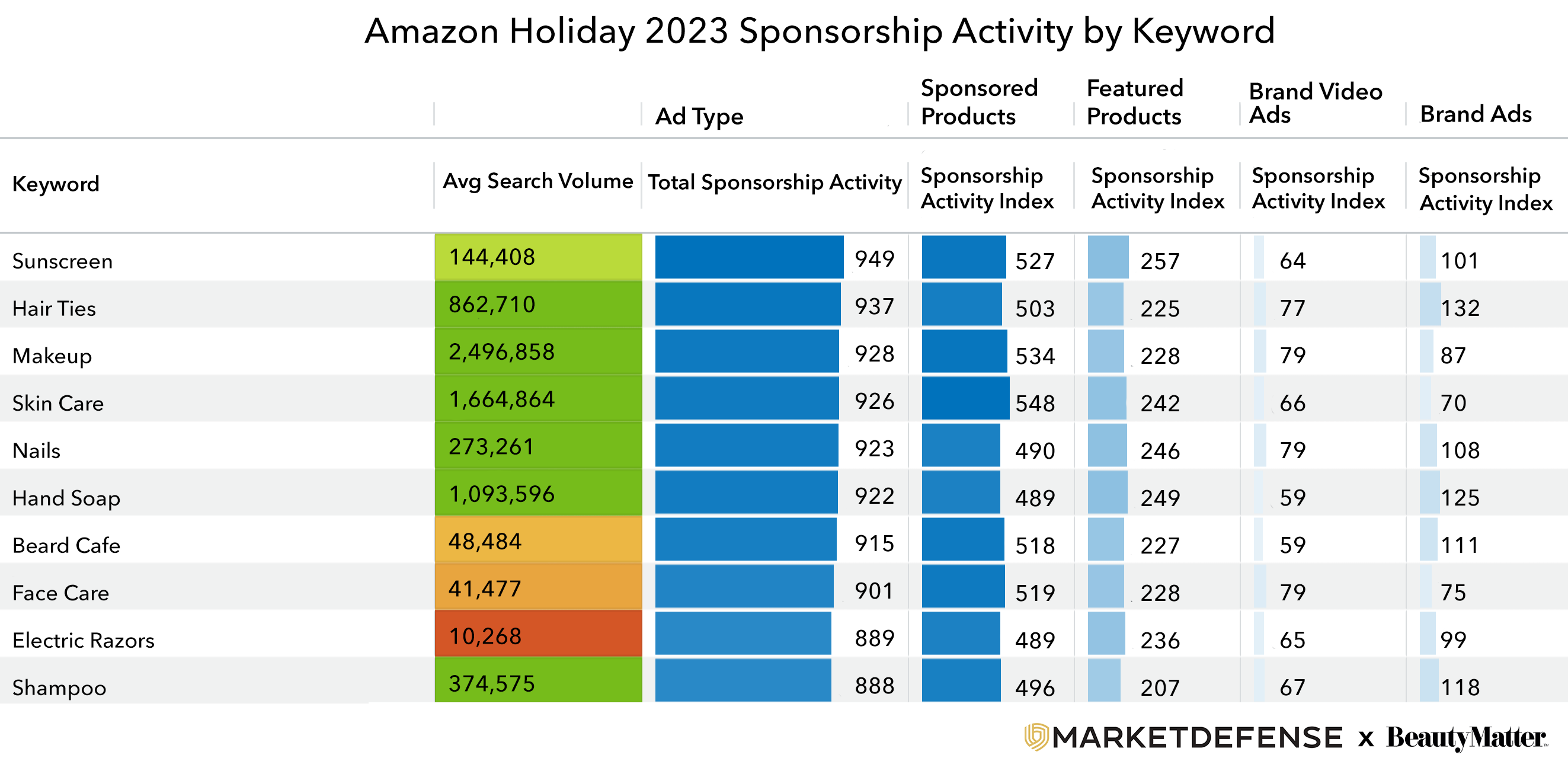

Top Sponsored Keywords:

Nonbrand keywords like "Sunscreen" are very competitive, with a lot of brands actively advertising on the keyword relative to the amount of search volume available. Most of the competition is focused on Sponsored Product Ads for these keywords, leaving the door open for brands to go after these competitive keywords with a good set of Sponsored Brand Ads and Sponsored Brand Video Ads.

"There are thousands of ways people search for beauty products on Amazon, but in each beauty category we know exactly which ones our clients should focus on. We know which 10% of keywords and products are driving 90% of the sales, and which are not. We don’t have to guess and test; we can get right to work driving sales," said Dave Karlsven, SVP of Client Marketing and Data Science at Market Defense.

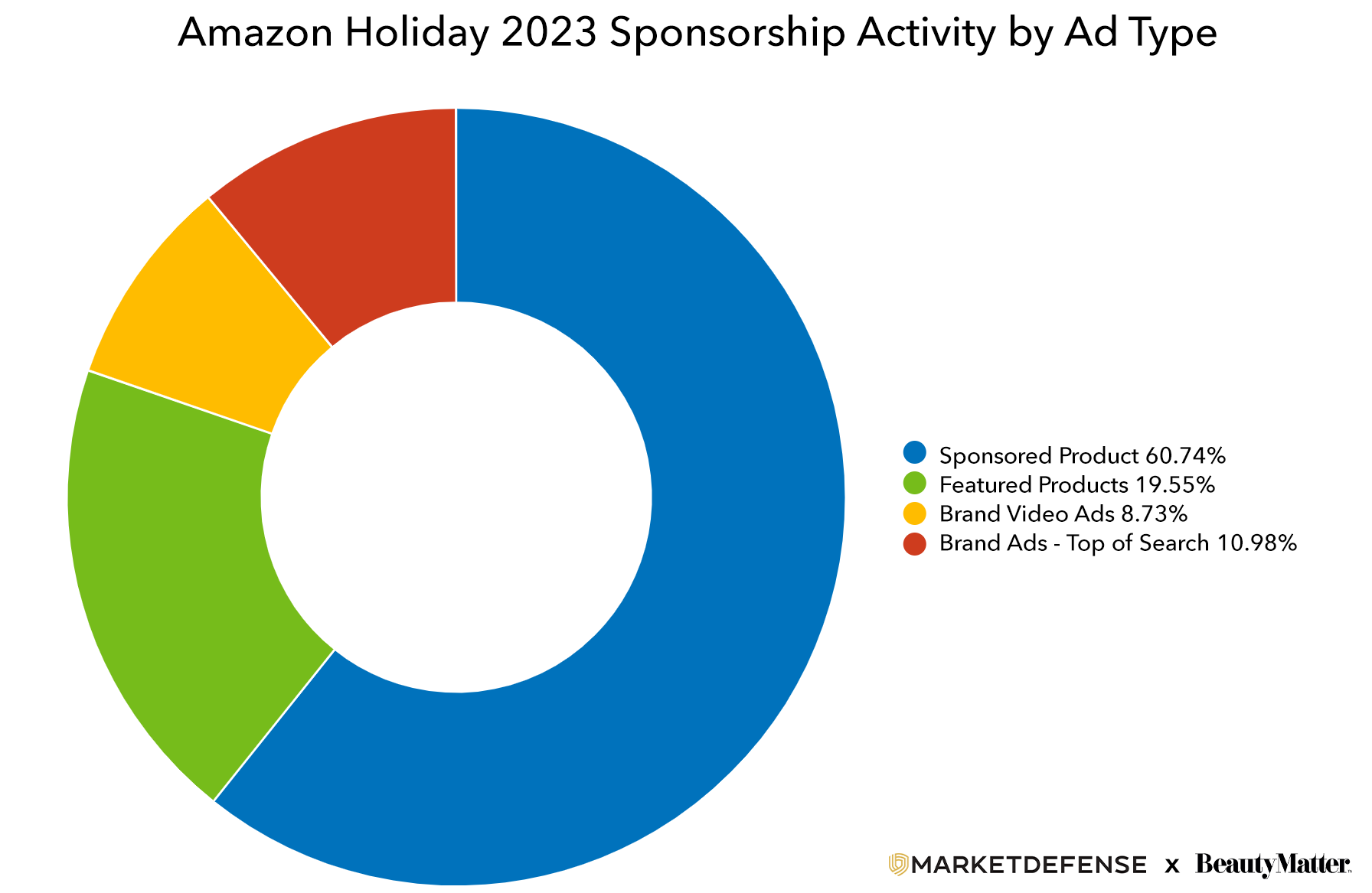

Sponsorship Activity by Ad Type:

Sponsored Product Ads remain the primary ad type brands use on Amazon. Brands that take advantage of Sponsored Brand Ads and Sponsored Brand Video Ads can often drive more impressions and a lower cost per click on the best keywords. Advertising revenues grew 27% YoY to $14.65 billion, ahead of StreetAccount’s estimate of $14.2 billion.

Market Defense’s team of data experts leverage AI tools to run data analysis, which informs better understanding and actionable insights on every brand, product, ad campaign, and keywords driving traffic and sales in every beauty category across Amazon and many other online marketplaces where beauty products are sold.

Karlsven said, “The data we gather allows us to make better decisions on budget allocation and execute on more advanced advertising strategies that produce bigger and faster sales growth for our clients.”

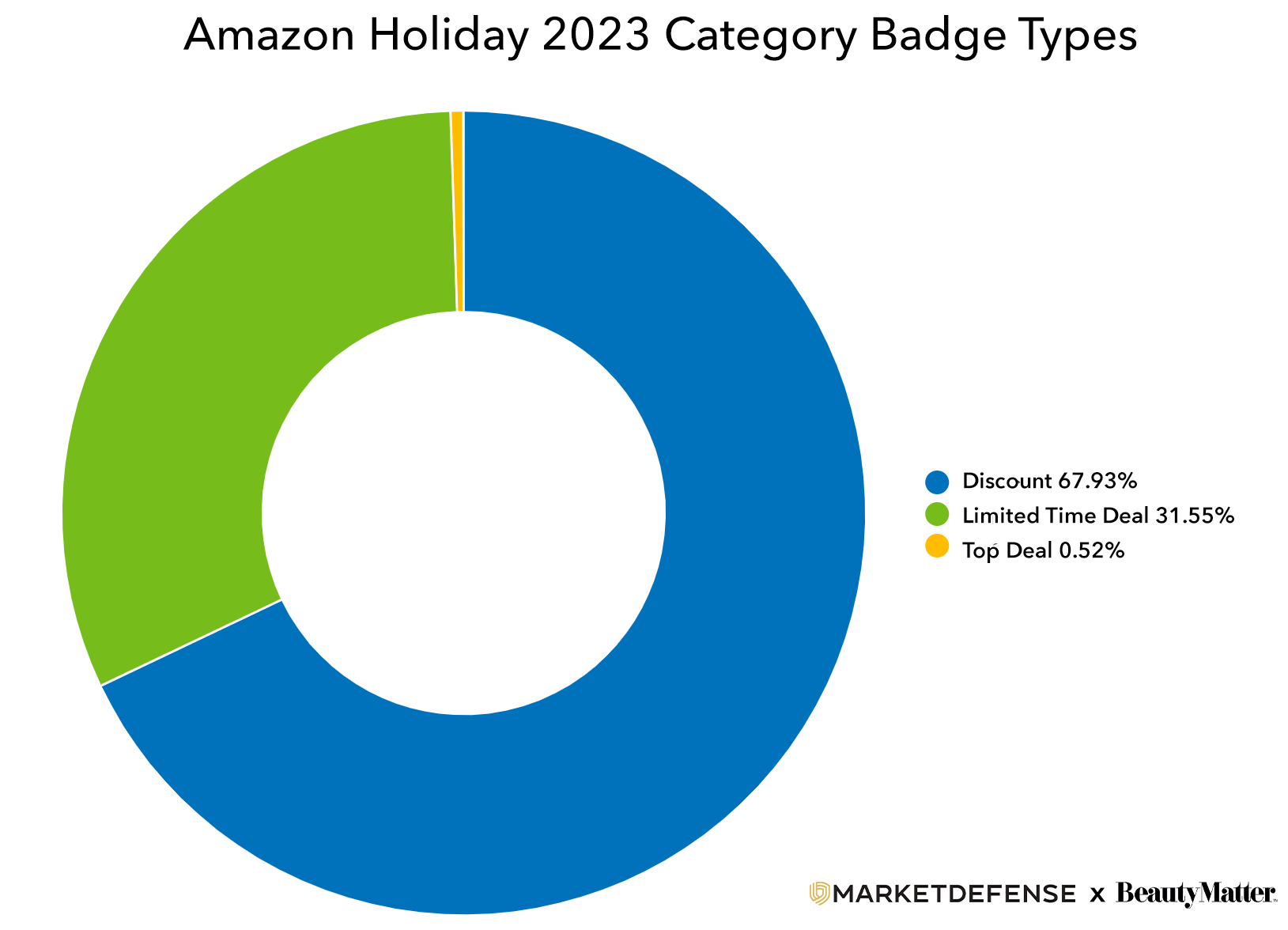

Category Badge Types:

Offering discounts remains the most popular option for brands trying to get more aggressive in their pricing and promotions.

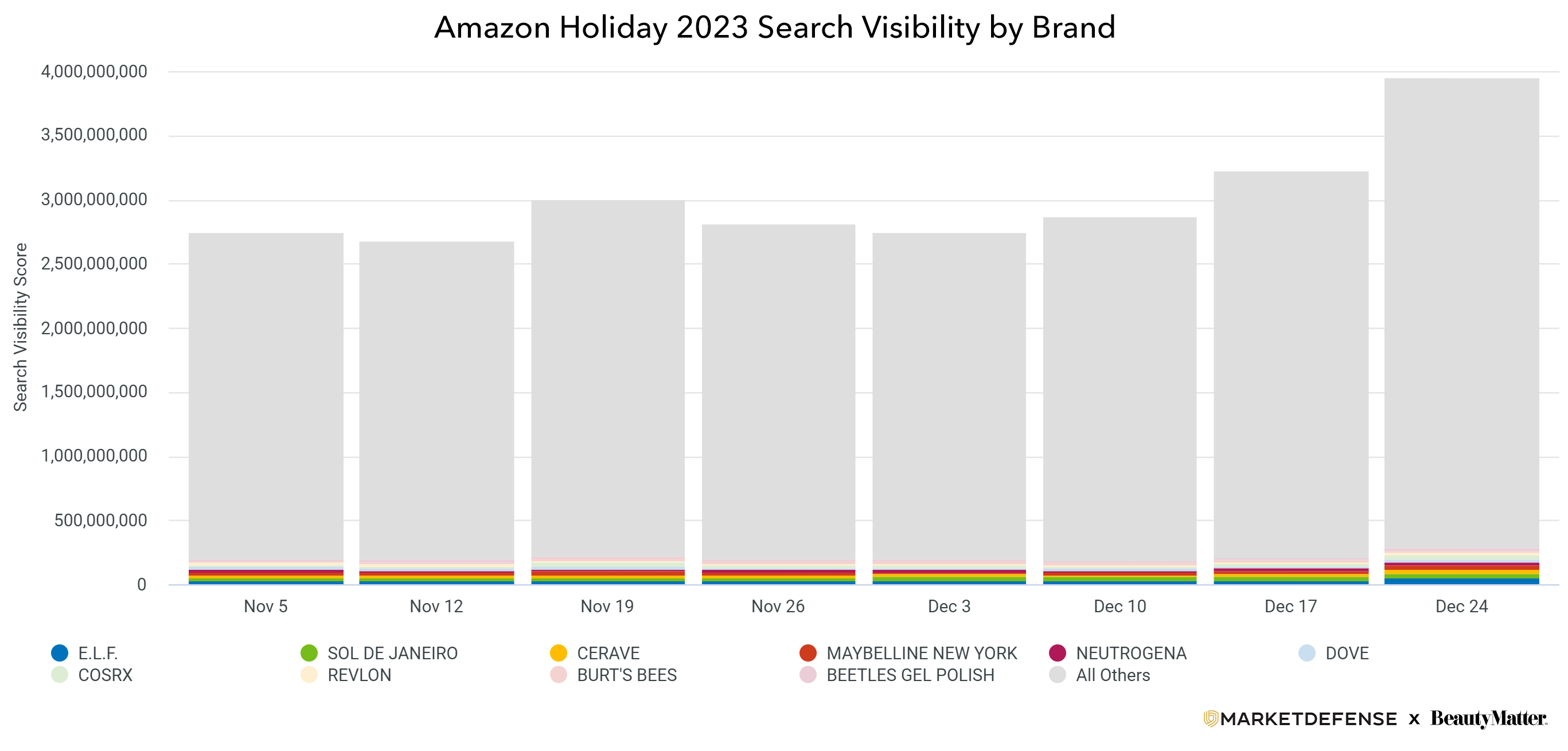

Search Visibility by Brand:

There are a lot of good brands in the beauty category that are being very aggressive with their marketing, so it can be tough to stand out and get more search visibility. But with the right strategies and a solid approach to optimizing and scaling both paid and organic traffic on the top searched keywords, there is a lot of Search traffic available to go after to drive more sales for your brand. Market Defense has a proven strategy for driving more Search Visibility on the best keywords that help Beauty brands win on Amazon and grow sales profitably.

Amazon saw a solid increase of 26% in its advertising business as it bolsters its position as a rival to ad behemoths Meta and Google. Karlsven predicts Amazon's advertising platform will continue to expand, offering more diverse and sophisticated ad formats.

According to Statista, the health and beauty segment is projected to be Amazon's second-fastest-growing product category from 2022 to 2027, with sales expected to increase at a CAGR of 12.1% from around $44 billion in 2022 to $79.4 billion by 2027.